Monday, March 7, 2016

Website Migration

Over the next few weeks I'll be migrating the posts here over to my new website recursivetrader.com. I'll also be directing more of my focus to developing an algorithmic trading strategy, primarily with the Python programming language (as well as a bit of Java since that's the API provided by Interactive Brokers). If that sounds interesting to you, be sure to check it out!

Wednesday, February 17, 2016

Correlating Promoters Part II

Here is where we will gather the data and break down which promoters are most effective. I'll keep updating this post until I'm satisfied that we have a solid handle on which groups are important to keep track of.

02/16/2016

This week The Wolf and StockOfTheWeek pumped PVHO, getting an 18.3% rise out of it. They both also mentioned pumping PRKA last week so presumably both websites belong to the same entity. For the moment I'll let them each keep their own label in gmail but I'll consolidate them into one in the future.

The price action seems too choppy to buy and it's too cheap to short but the percentage move is decent so we won't dismiss them entirely as promoters. The PRKA chart looks horrible though so I won't even bother posting it.

Best American Stocks pumped CLOW which saw a 9.11% rise. It's actually interesting to see how long it took for any gains to materialize since I can see CLOW emails hit my inbox back on February 4th.

CLOW's chart looks much more interesting since it's actually at a level that would make shorting at least plausible. I'd want it to break through that high of around 63 cents and keep running before thinking about shorting but I'm still acclimating to the present-day promotion climate so I'm not sure if that's possible. Looking at the volume, it seems like the promoters were selling heavily into any attempts to breakout but we'll see. I'll keep my eye on it.

The Daily Stock Reporter which I've labeled EGM Firm Inc. based on their email disclaimers, has been pumping GOGY. One such disclaimer reports they have received $15,000 dollars compensation for the promotion though they apparently own zero shares. While GOGY did go up 29.05% (only a $0.009 increase), the chart is so ugly you wouldn't want to waste your time looking at it.

Beat Penny Stocks promoted SNDY. I had originally grouped Beat Penny Stocks with Penny Picks because they were sending identical emails but I can now see in one of their email disclaimers that their true entity name is Stellar Media Group, LLC so I'll change my labels for both of these newsletters to reflect that. According to the disclaimer, the group received $12,500 dollars to promote SNDY. We can also dismiss SNDY as a tradable ticker. The chart is too gross.

02/16/2016

This week The Wolf and StockOfTheWeek pumped PVHO, getting an 18.3% rise out of it. They both also mentioned pumping PRKA last week so presumably both websites belong to the same entity. For the moment I'll let them each keep their own label in gmail but I'll consolidate them into one in the future.

The price action seems too choppy to buy and it's too cheap to short but the percentage move is decent so we won't dismiss them entirely as promoters. The PRKA chart looks horrible though so I won't even bother posting it.

Best American Stocks pumped CLOW which saw a 9.11% rise. It's actually interesting to see how long it took for any gains to materialize since I can see CLOW emails hit my inbox back on February 4th.

CLOW's chart looks much more interesting since it's actually at a level that would make shorting at least plausible. I'd want it to break through that high of around 63 cents and keep running before thinking about shorting but I'm still acclimating to the present-day promotion climate so I'm not sure if that's possible. Looking at the volume, it seems like the promoters were selling heavily into any attempts to breakout but we'll see. I'll keep my eye on it.

The Daily Stock Reporter which I've labeled EGM Firm Inc. based on their email disclaimers, has been pumping GOGY. One such disclaimer reports they have received $15,000 dollars compensation for the promotion though they apparently own zero shares. While GOGY did go up 29.05% (only a $0.009 increase), the chart is so ugly you wouldn't want to waste your time looking at it.

Beat Penny Stocks promoted SNDY. I had originally grouped Beat Penny Stocks with Penny Picks because they were sending identical emails but I can now see in one of their email disclaimers that their true entity name is Stellar Media Group, LLC so I'll change my labels for both of these newsletters to reflect that. According to the disclaimer, the group received $12,500 dollars to promote SNDY. We can also dismiss SNDY as a tradable ticker. The chart is too gross.

Tuesday, February 16, 2016

Correlating Promoters Part I

It has been a while since I've look at penny stock promoters so I figured I'd get back into the game by tracking the performance of the various promoters. Back in the day, there were a few big name promoters like Awesome Penny Stocks, Best Damn Penny Stocks, etc. I know many of those guys fizzled over time and became less effective as their notoriety increased.

To see who (if anyone) has taken over this niche with effective stock promotion, I'll be starting from scratch, learning who the players are. If you're new to this site and penny stock trading, I should emphasize now that the stocks being promoted by newsletters are almost definitely horrible companies and should be treated as such. Do not believe anything a newsletter tells you because they are being paid by someone to say it. Read the disclaimers in each email!

There are so many promoters that come and go, it would be a waste of time to track them all. Most of them don't create enough volatility to make trading their tickers worth it. By tracking the performance of various promoters, we can get a handle on who we should pay attention to-- and more importantly, who not to waste our time with.

Ideally we want to find promoters that are able to catalyze significant price moves that will more for good short sells. In all likelihood, a stock promoted by a newsletter is trash and any upward movement will result in future predictable downward movement that we can profit from. We might also consider buying before a run-up but considering the current market conditions, I really, really doubt that will be a viable strategy.

The first step is to gather all the newsletters you can. A simple and effective way to do this is to just search "penny stocks" on google. Click on all those promoted links on the top and on the side that are promising you the best stock picks. You'll want a separate email account for this since we are literally gathering spam which you won't want in the same email account you use for other important correspondence.

One helpful tip about email addresses is that you can amend labels to the email address by using a plus sign. For example, if your email address is myemail@gmail.com, you can provide myemail+whateverlabelyouwant@gmail.com and it will still be considered a perfectly valid email address.

We can use this to our advantage by giving each newsletter it's own distinct label. So when I'm signing up for the newsletter of http://moneymorningresearch.com/, I can give them the email address myemail+moneymorning@gmail.com. This way, if a newsletter shares our email address with any other groups, we can see who we originally gave the email to since it will still have that label with it. In the future I'll post some pictures to illustrate how this works.

Each promoter operates several different stock promotion websites so our goal is to figure out which promoters own which sites. In the past, this was often as easy as reading the bottom of each email to see the name of the parent company. This doesn't seem to be the case anymore which is partly what spurred me to write this guide. I'll try to do some of this work so that others don't have to.

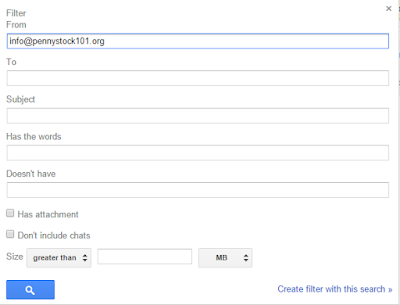

Gmail makes this process easier by allowing us to create filters and labels for each email sender. When you receive an email you'd like to create a filter for, click the drop-down menu beside the reply button and choose "Filter messages like this".

To see who (if anyone) has taken over this niche with effective stock promotion, I'll be starting from scratch, learning who the players are. If you're new to this site and penny stock trading, I should emphasize now that the stocks being promoted by newsletters are almost definitely horrible companies and should be treated as such. Do not believe anything a newsletter tells you because they are being paid by someone to say it. Read the disclaimers in each email!

Why is this information useful?

Ideally we want to find promoters that are able to catalyze significant price moves that will more for good short sells. In all likelihood, a stock promoted by a newsletter is trash and any upward movement will result in future predictable downward movement that we can profit from. We might also consider buying before a run-up but considering the current market conditions, I really, really doubt that will be a viable strategy.

Gather the newsletters

The first step is to gather all the newsletters you can. A simple and effective way to do this is to just search "penny stocks" on google. Click on all those promoted links on the top and on the side that are promising you the best stock picks. You'll want a separate email account for this since we are literally gathering spam which you won't want in the same email account you use for other important correspondence.

One helpful tip about email addresses is that you can amend labels to the email address by using a plus sign. For example, if your email address is myemail@gmail.com, you can provide myemail+whateverlabelyouwant@gmail.com and it will still be considered a perfectly valid email address.

We can use this to our advantage by giving each newsletter it's own distinct label. So when I'm signing up for the newsletter of http://moneymorningresearch.com/, I can give them the email address myemail+moneymorning@gmail.com. This way, if a newsletter shares our email address with any other groups, we can see who we originally gave the email to since it will still have that label with it. In the future I'll post some pictures to illustrate how this works.

Organize the newsletters

Gmail makes this process easier by allowing us to create filters and labels for each email sender. When you receive an email you'd like to create a filter for, click the drop-down menu beside the reply button and choose "Filter messages like this".

You'll be given the option to make the filter more specific if you'd like. For our purposes, the default will work fine. Click "Create filter with this search" to continue.

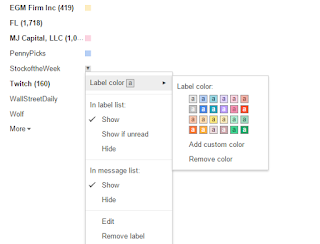

The next dialog asks what you'd like to do with the message. Check the box next to "Apply the label" and then select "New label...". Give your label a name that reflects the promoter who sent the email. Since we don't yet know which promoters own which sites, you'll need to create a new label for each newsletter site you subscribe to.

Lastly, we can assign our new labels with colors. This allows us to glance at our inbox and immediately see which promoters are promoting which stocks. This will become more useful as we whittle down our labels to only the most influential promoters.

I'll come back to this and expand on how to use this information in a future post. So keep checking back and in the meantime trade cautiously!

Thursday, April 16, 2015

Review: Robinhood

I’ve been using the Robinhood app for a few months now and have

executed a small handful of trades. There is much to like about the app as the

aesthetics of the GUI have been carefully implemented so as to achieve a very

neat streamlined feel. There is certainly no danger of cluttered data views

overloading you with information as some other apps seem to do.

Unfortunately, sleek and sexy interfaces are not the

qualities I value most in my trading applications. Relevant, concise, and

consolidated data views in conjunction with intuitive interfaces catered to

speed are the qualities that will help you make money with your trades. While

using the app there were too many times I found myself stumbling through views

looking for my order history or even my open positions. It’s a special kind of

frustration to be stuck in a trade for longer than you’d like because you have

to waste time figuring out how to get out.

It also worried me that being offered only a single point of

access to my account, the app, I could become stuck in trades if my device

froze up, broke, or otherwise became unavailable for use. There was no backup

computer-based application to turn to.

Before I make myself seem too much like a bumbling old

geezer struggling to grasp the concept of technology, I should say that it was

actually the simplicity of the app that caused me the most problems. The

linearly nested structure of navigation made me feel as though I were sitting

at someone else’s computer attempting to find files hidden within arbitrarily

named folders. I would have preferred a navigational scheme that branched out

from a central point so getting to what you’re looking for required fewer

clicks. Don’t fear the clutter Robinhood, we need speed!

Worse still, I would never have felt confident basing a

trade solely on the chart views offered within the app itself. It simply wasn’t

robust enough to allow me to make an informed decision. And by forcing the use

of secondary software, it really limited the usefulness of the app.

So at this point the free trades were the only remaining

attractive quality but what demographic does this serve? Serious traders who

place many trades might benefit the most from a lack of fees but would scoff at

the limited set of features and deprioritizetion of speed. And would the casual

trader who only places a few trades a year actually be saving money if they

made those trades using the limited information offered by the app? My guess

would be that a more developed, feature-rich application is worth the cost of

trading fees.

If Robinhood has any hope of success, they need to expand

their offerings to entice more people. Have some sort of backup to trade with

if the app isn’t working (even if it's just another android app). Offer margin accounts or an API to extend its

usefulness. There is hope, but at this point I can’t offer any enthusiastic

endorsements for Robinhood.

Wednesday, January 29, 2014

Simple Logic for Trading Herbalife (HLF)

The current situation regarding Herbalife is getting a lot of media attention so I thought I'd throw some cold logic into the mix.

The premise is that Herbalife, a multi-billion dollar multilevel marketing nutritional distributor, stands accused of operating a pyramid scheme. It seems that the main proponent of this accusation is Bill Ackman, a successful hedge fund manager of Pershing Square Capital Management LP which essentially placed a billion dollar bet that Herbalife was fraudulent and thus worthless.

While these accusations aren't new, Senator Edward J. Markey has recently asked regulators to investigate the issue. There have also been reports that Canada's top regulator has begun looking into the issue.

A quick scan of the twitter buzz on $HLF will make it clear that there are innumerable ways to spin and convolute the issue at hand. To me though, things are pretty cut and dry.

Does it really make sense to buy a stock that is under immediate threat of being found fraudulent?

It doesn't really matter what's true and what's being exaggerated for the short term. At this point, the risk of a major drop greatly outweighs the potential gain of treating this as a bounce play.

The premise is that Herbalife, a multi-billion dollar multilevel marketing nutritional distributor, stands accused of operating a pyramid scheme. It seems that the main proponent of this accusation is Bill Ackman, a successful hedge fund manager of Pershing Square Capital Management LP which essentially placed a billion dollar bet that Herbalife was fraudulent and thus worthless.

While these accusations aren't new, Senator Edward J. Markey has recently asked regulators to investigate the issue. There have also been reports that Canada's top regulator has begun looking into the issue.

A quick scan of the twitter buzz on $HLF will make it clear that there are innumerable ways to spin and convolute the issue at hand. To me though, things are pretty cut and dry.

Does it really make sense to buy a stock that is under immediate threat of being found fraudulent?

It doesn't really matter what's true and what's being exaggerated for the short term. At this point, the risk of a major drop greatly outweighs the potential gain of treating this as a bounce play.

Thursday, November 28, 2013

Upgrade Your Bathroom Experience

I'm going to propose an idea here. Sure, you may think it's a little ridiculous at first but hear me out.

Traders are constantly at risk of being betrayed by their bodies. Say you're watching a stock setting itself up for some perfect technical indicator. You wait patiently for the perfect moment to pull the trigger. Then you realize you really have to pee. Do you miss the perfect opportunity? Or worse still, do you pull the trigger and run off, hoping the stock will cooperate with you and continue with the trend you expected. Hundreds or thousands of dollars could be on the line. That's one expensive pee break. One can only imagine the sort of devastation if you had to go number two.

How about we solve that problem? Technological solutions are already entirely pervasive in our modern world. It's about time we make the transition to dedicated bathroom computing.

I don't think you could find a better choice than the Acer Aspire E1-531-4665.With 2.2GHz of processing speed and 4GB of RAM, you'll be placing trades and checking email faster than you can say 2-ply.

Traders are constantly at risk of being betrayed by their bodies. Say you're watching a stock setting itself up for some perfect technical indicator. You wait patiently for the perfect moment to pull the trigger. Then you realize you really have to pee. Do you miss the perfect opportunity? Or worse still, do you pull the trigger and run off, hoping the stock will cooperate with you and continue with the trend you expected. Hundreds or thousands of dollars could be on the line. That's one expensive pee break. One can only imagine the sort of devastation if you had to go number two.

How about we solve that problem? Technological solutions are already entirely pervasive in our modern world. It's about time we make the transition to dedicated bathroom computing.

I don't think you could find a better choice than the Acer Aspire E1-531-4665.With 2.2GHz of processing speed and 4GB of RAM, you'll be placing trades and checking email faster than you can say 2-ply.

Tuesday, November 12, 2013

Just As I PHOT

There's no denying that the chart of PHOT looks good today. It could be on the verge of a breakout which would be a huge buy indicator. It also has good volume and plenty of investor interest. It's a medical marijuana company which is a hot sector. Unfortunately, it seems that it is a little bit too good to be true, which is what I first thought as soon as I saw the word marijuana paired with OTC. Much of their success should be attributed to hype rather than solid fundamentals (the latter being what you should prefer in a breakout play).

So What's Wrong?

The first question I ask myself when visiting a company's website for the first time is: "Are they selling products or stock?" In other words, is the company profiting from what they claim to specialize in, e.g. medical marijuana accessories, or just from convincing investors that they're a good company worth giving money to.Below is a screenshot of their company webpage which at first glance is absolutely selling the stock rather than any products. Go look at any company you trust and check out their website. Chances are, you won't even see a ticker symbol on the page. If you do, they're usually hidden in the footer with a link for investors. Growlife on the other hand features everything you need to know about buying the stock rather than real products. It even includes a headline on the front page that predicts the stock will double in share price. That alone would be a big red flag for me.

Fundamentals

If you're still wondering if you should give them the benefit of the doubt, check the numbers. They aren't pretty. According to their latest 10-Q, the company has less than a quarter-million cash on hand but they have doubled their total liabilities to over three million since last December. Operating losses are growing rather than diminishing over time which doesn't bode well for their future. As of June 30th of this year, they've experienced a net loss of ~2.8 million dollars compared to a loss of ~878,000 that time last year. Not exactly the kind of success story I'd like to buy into.How Do I Trade It?

Same as anything else! It depends on price action. If that 10 cent level breaks on high volume, it's a buy indicator regardless of how poor the company is. Hype moves stock and there's no reason you shouldn't be profiting from that. That being said, you'll be one of the smart buyers who will know that this company doesn't deserve to be breaking out to new highs. I'm hoping you know enough not to hold onto it if you do buy it.If you were thinking about shorting it, you've got the right idea but it probably isn't worth it. At 10 cents and solid support at 5 cents, there just isn't enough downside to make the risk worth it. Personally, if the stock fails to break 10 cents I wouldn't pay much more attention to it.

Subscribe to:

Posts (Atom)